Building a house is an exciting and rewarding endeavor, but it also requires careful planning and understanding of the construction process. In British Columbia, Canada, the construction process involves several crucial steps that must be followed to ensure a successful and compliant project. Whether you’re a homeowner embarking on a new construction project or simply curious about the process, this comprehensive guide will walk you through the house construction process in British Columbia.

Preparing the Site:

- The first step in building a house is preparing the site. This involves clearing the land, leveling the ground, and preparing the foundation. It is essential to obtain the necessary permits and conduct surveys to ensure compliance with local building codes and regulations.

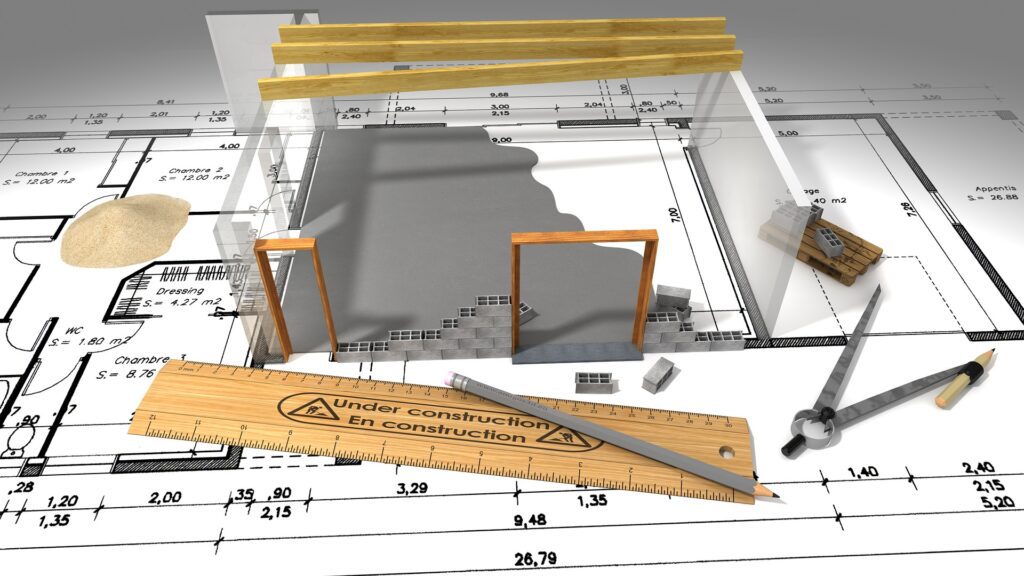

Design and Planning:

- Before construction begins, it is crucial to develop a detailed design and plan for your house. This includes working with an architect or a designer to create blueprints, floor plans, and construction drawings. In British Columbia, adherence to the BC Building Code and other relevant regulations is essential during the design and planning phase.

Building Permits and Inspections:

- To proceed with construction, you will need to obtain the required building permits from the local municipality. The permitting process typically involves submitting your construction plans, paying applicable fees, and ensuring compliance with zoning and environmental regulations. Regular inspections will be conducted at various stages of construction to ensure adherence to safety standards and building codes.

Foundation Construction:

- The construction of the foundation is a critical phase in building a house. This involves excavating the site and pouring the foundation walls and footings. The foundation provides structural support and ensures the stability of the house.

Framing:

- Once the foundation is complete, the framing stage begins. This includes erecting the structural framework of the house, including walls, floors, and roof systems. Framing involves the use of wood or steel studs, beams, and trusses to create the skeleton of the house.

Plumbing, Electrical, and HVAC:

- After the framing is complete, the next step involves installing the plumbing, electrical, and HVAC (Heating, Ventilation, and Air Conditioning) systems. This includes the installation of wiring, pipes, fixtures, and heating/cooling units. Licensed professionals must handle these installations, ensuring compliance with building codes and safety regulations.

Insulation and Drywall:

- Insulating the walls, floors, and ceilings is crucial to ensure energy efficiency and comfort in the house. After insulation, drywall is installed to cover the framework, creating the interior walls and ceilings. Skilled contractors perform this task, paying attention to fire safety regulations and soundproofing requirements.

Interior Finishes:

- During this phase, the house starts to take shape aesthetically. Interior finishes include flooring, painting, trim work, installing cabinetry, and other decorative elements. Homeowners can choose materials, colors, and finishes to suit their preferences and budget.

Exterior Finishes:

- The exterior finishes play a vital role in protecting the house from the elements and enhancing its curb appeal. This includes siding installation, roofing, windows, doors, landscaping, and the construction of outdoor structures such as decks and patios.

Final Inspections and Occupancy:

- Once construction is complete, the final inspections are conducted to ensure compliance with all building codes and regulations. These inspections cover all aspects, including structural integrity, safety, electrical systems, and plumbing. Upon receiving approval, you can obtain an occupancy permit, allowing you to move into your new house.

Building a house in British Columbia, Canada, requires careful planning, adherence to regulations, and coordination with various professionals and authorities. The construction process involves multiple stages, from site preparation to final inspections. By following these steps and working with licensed professionals like Silver Beam Homes.

read more

Recent Comments